1,300 jobs, $90 million annual economic impact would be generated by shopping center, says EEDC

Area residents recently had the opportunity to view the U.S. Marines dress uniform, complete with military decorations, of the late Alfredo “Freddy” González of Edinburg. The Texas icon, whose bravery and sacrifice during the Vietnam War prompted the nation a generation ago to bestow upon him the Congressional Medal of Honor, has now been recommended for the state’s highest military award – The Texas Legislative Medal of Honor. Rep. Aaron Peña, D-Edinburg, has filed the needed legislation nominating the combat Marine for the exclusive state honor. See story later in this posting.

••••••

Sen. Juan “Chuy” Hinojosa, D-McAllen, on Tuesday, February 27, spoke from the front steps of the Texas Capitol during a rally drawing attention to legislative efforts to reduce electricity rates for Texas residential users. A large gathering showed up for the event, which included members of the American Association of Retired Persons. AARP is supporting Hinojosa’s Senate Bill 444, a bill designed to bring stability to the state’s deregulated electricity market. Rates have risen by as much as 100 percent in the past five years, Hinojosa said, giving Texas one of the highest rates in the nation. See story later in this posting.

Sen. Juan “Chuy” Hinojosa, D-McAllen, on Tuesday, February 27, spoke from the front steps of the Texas Capitol during a rally drawing attention to legislative efforts to reduce electricity rates for Texas residential users. A large gathering showed up for the event, which included members of the American Association of Retired Persons. AARP is supporting Hinojosa’s Senate Bill 444, a bill designed to bring stability to the state’s deregulated electricity market. Rates have risen by as much as 100 percent in the past five years, Hinojosa said, giving Texas one of the highest rates in the nation. See story later in this posting.

••••••

Julie González of Edinburg. featured here in the Senate chamber with her boss, Sen. Eddie Lucio, Jr., D-Brownsville, is one of several Edinburg residents who are working in key positions of influence at the State Capitol in Austin. González is serving as a legislative aide with the Senate Committee on International Relations and Trade, which is chaired by Lucio, whose legislative district includes portions of Edinburg. See story later in this posting.

Julie González of Edinburg. featured here in the Senate chamber with her boss, Sen. Eddie Lucio, Jr., D-Brownsville, is one of several Edinburg residents who are working in key positions of influence at the State Capitol in Austin. González is serving as a legislative aide with the Senate Committee on International Relations and Trade, which is chaired by Lucio, whose legislative district includes portions of Edinburg. See story later in this posting.

••••••

1,300 jobs, $90 million annual economic impact would be generated by shopping center, says EEDC

By DAVID A. DIAZ

A proposed $80 million retail shopping center that has been in the development stage for about a year would create 1,300 jobs and have an estimated $90 million annual economic impact in the three-time All-America City, the Edinburg Economic Development Corporation has announced.

The first major estimate of the economic impact of the complex was released by the EEDC during its board of directors meeting on Tuesday, February 27.

The shopping center, being developed by First Hartford Realty Corporation, Inc., which is based in Manchester, Connecticut, is scheduled to be built on about 130 acres of currently vacant fields in south-central Edinburg.

The targeted site is bordered by U.S. Expressway 281 and Business Highway 281 to its east and west, respectively, with Trenton Road serving as its southern border.

“The 1,300 jobs, and probably be more, represents employment at the shopping center, which will be developed in phases over three years, once that project is completed,” said EEDC executive director Ramiro Garza, Jr. “After that, over a 10-year period, the economic impact of the shopping center will approach $1 billion.”

Groundbreaking at the site for the first phase of the shopping center, which could take up to three years to complete, is tentatively scheduled for early summer, he said.

As part of its strategies to help promote the creation of the retail center, the EEDC board of directors on February 27 approved a resolution authorizing the EEDC, which is the jobs-creation arm of the Edinburg City Council, to participate in key incentives to help spur the project.

The EEDC, a governmental entity, is chaired by former Mayor Richard García, and includes Mayor Joe Ochoa, Fred Palacios, Mike Govind, and George Bennack on its five-member board of directors.

The board of directors are appointed by the city council, with the exception of the mayor, who is automatically on the governing board.

At that Tuesday evening public session, the EEDC gave its official approval to a proposed package of economic incentives – adopted a week earlier by the city council – that would help the outdoor retail stores developer cover certain portions of the costs of making the retail complex a reality.

Those incentives, which would involvement reimbursements for public infrastructure, such as new water and wastewater lines and roadway improvements, would materialize only if the shopping center meets specific benchmarks required under the incentives proposal.

“It’s all tied to their performance,” said Garza. “The agreement is structured in such a way that they have to hit certain performance measures.”

Those benchmarks include the shopping reaching a certain level of local sales taxes generated, new jobs created, and retail space constructed three years from its groundbreaking.

The proposal, approved by the city council and EEDC, “commits the developer to build at least 800,000 square feet of retail space and create 1,300 jobs over a period of three years,” Garza said.

The proposed incentives have been in the works for months by the city council and EEDC board of directors during their respective public meetings.

To that end, the city council has been working on creating a special city panel that could designate the shopping mile site as a Tax Increment Refinancing Zone, otherwise known as a TIRZ. But before that entity is formed, the city and EEDC wanted to have the incentives proposal ready, Garza added.

TIRZs are special districts created by a city council or other governmental entity, such as the county government, to bring new investments into a community.

TIRZs are authorized by state law to help local governments help pay the cost of redeveloping or encouraging development in a region that has no planned economic activity.

“That process will be initiated in the next month or so designating the areas of the TIRZ and capturing all the incremental value of the construction activity there, and utilizing that to reimburse (the shopping center developer) for public improvements,” he said.

First Hartford Realty Corp., Inc. is designing a “Lifestyle-Themed” complex to be located between U.S. Expressway 281 and Business Highway 281 in south Edinburg, bordering Trenton Road to the north.

Last spring, company leaders provided the first major update of their goals.

“We are pleased to announce our plan to develop the property which is being designed to host a variety of national and regional retailers, sit-down restaurants and other retail amenities,” said John Toic, Director of Project Development for First Hartford Realty Corp., Inc.

“In addition, the site is being designed to accommodate possible hotel and entertainment uses as well. The center will serve the expanding base of Rio Grande Valley shoppers and will draw shoppers from throughout the region and Mexico,” he added.

The company has more than 50 years of national real estate development experience.

The proposed retail mecca would be the latest big addition to the city’s continuing economic growth.

Plans for the shopping center were first announced about a year ago by then Mayor García, and both he and current Mayor Ochoa are leading the city’s efforts to package the incentives.

“Those involved in the development agreement that is currently being negotiated, and hopefully will be finalized very shortly, with the developers of the proposed mall project to provide an incentives- based economic development package,” City Attorney Dan Ríos said February 20. “If First Hartford meets certain specific goals throughout the development of the project, the city, in accordance with state laws, will provide for certain incentives for that development.”

He said some of those incentives to be offered by the city include “reimbursements for public improvements that would be dedicated for public use, and also involve certain levels of sales tax incentives and reimbursements, provided they meet construction of square footage. It is a phased-in incentive package.

“If they (First Hartford) meet additional goals, they would be able to seek additional economic incentives,” Ríos said. “Those items that have been negotiated over the past several months would bring a major impact in terms of development and growth that would benefit the city and its citizens. We are pleased with a developer that is contemplating making that type of investment in the area, and that investment, in the council’s view, justified serious consideration of this economic package.”

“First Hartford has advised the city that a significant contributing factor that would induce First Hartford to locate and construct the facility in the city is the ability to obtain certain economic development incentives to would assist First Hartford in being able to finance to facility,” Ochoa added.

One component of the economic development incentives being provided to the shopping center’s developer, under the development agreement by the city, is a commitment from the city to grant to the First Hartford a portion of the city’s one percent sales tax revenues collected within the Tax Increment Reinvestment Zone to be created by the city, said García.

The city is authorized under Texas law to grant public funds for economic development purposes pursuant to a “program” established under Chapter 380 of the Texas Local Government Code. A resolution approved Tuesday, February 20, by the city council authorizes the establishment of such programs, which must occur before the city grants public funds for economic development purposes.

As a result of the passage of that resolution that evening, the city is able to provide a one percent city sales tax grant detailed in the development agreement.

As part of its economic development strategies, the city council previously authorized the creation of the Local Government Finance Corporation (LGC) to assist with financing and constructing economic development projects within the city in order to promote economic development and to stimulate business and commercial activity in the city, all at the request of the city council.

More details on the mechanism of a Tax Increment Reinvestment Zone are provided by the City of Houston, which has 22 TIRZs.

According to the City of Houston’s web site:

What Are Tax Increment Reinvestment Zones (TIRZs)?

Tax Increment Reinvestment Zones (TIRZs) are special districts created by a city council or other eligible local government to attract new investment to an area. TIRZs help finance the cost of redeveloping or encouraging infill development in an area that would otherwise not attract sufficient market development in a timely manner. Taxes attributable to new improvements (tax increment) are set-aside in a fund to finance public improvements in the zone.

Zones in the City of Houston have been created for one of three reasons:

•To address inner city deterioration;

•To develop raw land in suburban fringe areas; or

•To proactively address the decline of major activity centers.

How They Work

TIRZs are most successful when the area’s tax base is at a low point of its valuation and there is a large property owner/developer who can expeditiously carry out the area’s redevelopment. The term TIF, or tax increment financing, is used interchangeably with TIRZs.

As new construction in the zone occurs, the resulting annual incremental increase in tax revenue above the base amount is returned to the zone for the duration of the zone. For example, if the assessed value for a base year is set at $6 million and improvements to the area increase the assessed value to $7 million; the taxes collected on the additional $1 million, or increment, is earmarked for the TIRZ fund to pay for project costs. TIRZs have no taxing or assessment powers.

Property owners pay a normally increasing tax bill. The cost to the city is that the increment that is captured is preempted for use in the zone rather than for the City’s general fund.

Eligible Project Costs

Eligible project costs are associated with public improvements. These improvements can include capital costs (the acquisition and construction of public works and public improvements, and building rehabilitation costs); financing costs (including all interest); real property assembly; relocation costs; professional services; and, creation, organization and administrative costs.

Projects that are implemented prior to an increment being realized are often financed by a developer and are later reimbursed as an increment is realized, or through the issuance of bonds. Projects can also be financed on a pay-as-you-go basis.

Types of Zones

TIRZ’s can be city-initiated, if less than 10% residential land area, or by a petition. TIRZs created by petition must be submitted by owners of property constituting more than 50% of the appraised value of the area. Additional areas can be annexed into the zone at a later time through the initiative of the city, if it meets the less than 10% residential rule, or by property owner’s petition. The zone, plus all other existing zones, may not exceed 15% of all taxable property in the city.

Governance

In Houston, a board of directors governs a TIRZ. Non-petitioned TIRZs are governed by between five and 15 directors. Each taxing jurisdiction levying taxes within the TIRZ are allotted one position on the board, while the Houston appoints a minimum of five directors. Petition TIRZ boards must have nine members that include: five city representatives (that must own or represent a property owner within the zone); one state senator appointment; one state representative appointment; one representative each from the county and school district (if participating in the zone). Houston city appointees serve two-year terms.

Houston may delegate to the board any powers granted under state law, except for eminent domain and taxing powers. Powers include land use controls, in special cases; design standards; recommendations for the administration of the zone; and, powers to implement a project and financing plan.

••••••

Sen. Hinojosa, Rep. Peña appointed by leadership to investigate problems in Texas Youth Commission

Lt. Governor David Dewhurst and Speaker of the House Tom Craddick, R-Midland, on Friday, March 2, announced Senate and House appointments – including Sen. Juan “Chuy” Hinojosa, D-McAllen, and Rep. Aaron Peña, D-Edinburg – to the newly created Joint Select Committee on the Texas Youth Commission (TYC).

The committee will be charged with studying recent allegations of sexual abuse at certain facilities administered by the TYC. It will also examine the agency’s policies and procedures, and make recommendations for how to improve its future oversight of youth being rehabilitated in these facilities.

“As leaders of this state, we will not tolerate abuse or cover up in any state agency,” Dewhurst said. “Our recommendation of a conservatorship allows immediate action to hold those involved accountable, correct any problems that still exist within TYC and put in place measures to prevent further abuse of those in the state’s custody and of the public trust.”

“The disturbing allegations about certain activities at the Texas Youth Commission warranted the immediate creation of this committee,” Craddick said. “I trust that the committee members will thoroughly review the situation in the Texas Youth Commission and ensure this agency gets back to helping our troubled youth.”

The committee will be co-chaired by Sen. John Whitmire D-Houston, Chair of the Senate Criminal Justice Committee, and Rep. Jerry Madden, R-Richardson, Chair of the House Corrections Committee.

The Senate appointees are Sen. Chris Harris, R-Houston; Sen. Juan “Chuy” Hinojosa, D-McAllen; Sen. Kel Seliger, R-Amarillo; Sen. Florence Shapiro, R-Plano; Sen. Royce West, D-Dallas; and Sen. Tommy Williams, R-The Woodlands.

The House appointees are Rep. Harold Dutton, D-Houston; Rep. Aaron Peña, D-Edinburg; Rep. Larry Phillips, R- Sherman; Rep. Debbie Riddle, R-Tomball; Rep. Sylvester Turner, D- Houston; and Rep. Corbin Van Arsdale, R-Tomball.

“Like many Texans I am outraged at the culture of neglect and deceit that is seemingly apparent at the Texas Youth Commission,” said Peña. “Since late 2005, when my office first received complaints out of the TYC’s Evins Unit, we have exerted considerable pressure on administration officials to address allegations of abuse and neglect. Despite assurances that the problems at the Evins Unit were isolated incidents it is abundantly clear that there are systematic deficiencies that must be addressed. I look forward to the opportunity to bring accountability to a system that appears broken.”

The Joint Select Committee on the TYC was created to coincide with the Legislative Audit Committee (LAC), which met on Friday, March 2, to examine the conduct and fiscal management at the TYC.

The committee voted unanimously to recommend that the governor appoint a conservatorship, and it also recognized that the Governor could create a state agency rehabilitation plan to be submitted within 15 days.

The LAC is a permanent standing joint committee, co-chaired by the Lt. Governor and the Speaker, whose role is to provide guidance to the State Auditor’s Office.

••••••

Texas Legislative Medal of Honor recommended for the late Sgt. Alfredo “Freddy” González of Edinburg

By DAVID A. DIAZ

More than a generation after Marines Sgt. Alfredo “Freddy” González died saving his troops in Vietnam, the Texas Legislature is poised to posthumously bestow upon him the state’s highest military decoration.

The Texas Legislative Medal of Honor, which has been awarded only three times previously, recognizes a member of the state or federal military forces “who performs a deed of personal bravery or self-sacrifice involving risk of life that is so conspicuous as to clearly distinguish the person for gallantry and intrepidity above the person’s comrades. Awarding this medal shall be considered on the standard of extraordinary merit. The medal may be awarded only on incontestable proof of the deed.”

The legislation, House Concurrent Resolution 121, was filed Monday, February 26, by Rep. Aaron Peña, D-Edinburg.

Sen. Juan “Chuy” Hinojosa, D-McAllen, is expected to sponsor the measure in the Senate, which will require approval by Gov. Rick Perry if the legislative resolution is adopted by the Texas Legislature.

“Freddy González is a true American hero,” said Peña. “It is the duty of our community to never forget the sacrifices of those brave men and women who serve our country. In recognizing Freddy González, we not only honor his remarkable life but we honor the countless contributions of many others who came before him.”

The military decoration is a neck ribbon is green with white stars, and the medal features an image of the Alamo Mission in San Antonio and the six historical flags of Texas.

John Flores, author of a new book, “Where the River Dreams” (Publisher: AuthorHouse), which chronicles the life of the Edinburg war hero, praised the decision to recommend the state’s highest military honor in memory of González.

“Freddy was a simple, hard-working country boy, humble and reserved, never seeking honors,” Flores said. “What Freddy did, he did for the men under his command. He was their leader at a time of maximum danger, and his greatest legacy is simply that they all knew Sgt. González would always be there right with them, no matter what the odds.”

The Texas Legislative Medal of Honor (TLMH) was established by the 58th Texas Legislature, and has been awarded three times throughout its history to those who voluntarily perform a distinguished deed of personal bravery, or self-sacrifice involving risk of life.

Prior to September 2003, the governor determined the TLMH nominees and awards the TLMH upon passage of a resolution confirming this person by both bodies of the legislature. Additionally, there were no residency requirements for the TLMH.

That law changed in September 2003, when the new law, authorized by House Bill 573, established certain residency requirements and TLMH nominating and awarding criteria. The legislation also established a committee of legislative branch officials and the Texas adjutant general to designate award recipients.

The resolution follows verbatim:

CONCURRENT RESOLUTION 121

WHEREAS, The Texas Legislative Medal of Honor was established to honor gallant and intrepid service by a member of the state military forces of Texas, and through his courageous actions in

Vietnam, Sergeant Alfredo “Freddy” González distinguished himself as a worthy recipient of this prestigious honor; and

WHEREAS, Born May 23, 1946, in Edinburg and a graduate of Edinburg High School, Sergeant González enlisted in the U.S. Marine Corps in May 1965; after his first tour of duty in Vietnam, he was chosen to train new marines for guerilla warfare; and

WHEREAS, A few months later, Sergeant González learned of an ambush in which men who had served under him had been killed; impelled by a strong sense of duty to his fellow marines and to his

country, he volunteered for a second tour in Vietnam; and

WHEREAS, When, at the end of January 1968, North Vietnamese and Viet Cong troops launched the massive Tet Offensive, Sergeant González and his platoon were ordered to Hue to relieve the pressure on that city; en route to Hue, the platoon’s convoy was hit by heavy fire on several occasions; during one such encounter, Sergeant González saw an injured marine lying in the road ahead and ran through enemy fire to carry the man to cover, receiving fragmentation wounds in the rescue; and

WHEREAS, With the column halted by withering fire from a fortified machine-gun bunker, Sergeant González proceeded to guide his men to a protective dike; he then moved out onto a road being

raked by the gun and destroyed the bunker with hand grenades; later, on February 3, Sergeant González was seriously wounded but continued to refuse medical treatment and to lead his men in their attack; and

WHEREAS, During fighting in Hue on February 4, his platoon of some 35 troops was again pinned down by a ferocious barrage; telling his unit to stay behind shelter, Sergeant González moved forward aggressively with hand grenades and small antitank rockets, firing numerous rounds against enemy emplacements; and

WHEREAS, Entering a church, where the North Vietnamese were heavily fortified, he succeeded in suppressing virtually all of their fire; before the last of it could be silenced, however, he was

mortally wounded; and

WHEREAS, Because he succeeded in destroying so many North Vietnamese positions, Sergeant González was credited with saving the lives of the men in his platoon; the following year, in consequence of his extraordinary and selfless action, he was posthumously awarded the Medal of Honor, becoming the only marine in combat during the Tet Offensive to receive that award; and

WHEREAS, For those with whom he served, the heroism displayed by Sergeant González was completely in character; “it seemed like he was everywhere all the time,” one remembered; “he was always there in the front, never in the back . . . he was always there for us”; and

WHEREAS, Among the awards subsequently conferred on Sergeant González were three Purple Hearts, four Presidential Unit Citations, and a Combat Action Ribbon, Good Conduct Medal, National

Defense Medal, and Cold War Certificate; in addition, he was the posthumous recipient of two South Vietnamese decorations–the Vietnam Cross of Gallantry with gold palm and star and the Vietnam

Service Medal with four bronze stars; in 1996, the U.S. Navy commissioned a new guided missile-destroyer in his honor; and

WHEREAS, Through his unhesitating selflessness and his unfaltering devotion to duty, honor, and his country, Sergeant Alfredo González embodied the highest ideals of the armed service, and he most assuredly merits the award of this state’s supreme military medal; now, therefore, be it

RESOLVED, That the 80th Legislature of the State of Texas hereby posthumously confer the Texas Legislative Medal of Honor on Sergeant Alfredo “Freddy” González in recognition of his heroic service and express to his family its deepest appreciation on behalf of all his fellow Texans; and, be it further

RESOLVED, That an official copy of this resolution be prepared for the family of Sergeant González as an expression of highest regard by the Texas House of Representatives and Senate.

••••••

Sen. Hinojosa, AARP rally for lower electric rates, stronger protection protections, more consumer choices

By MELISSA DEL BOSQUE

Members of the AARP gathered from all across the state Tuesday, February 27, to join State Sen. Juan ‘Chuy’ Hinojosa, D-McAllen, at a rally on the grounds of the Capitol in Austin, pressing their case for lower electric rates and more consumer choice.

“You voices are being heard inside this building today,” Hinojosa told the crowd. “And that’s why we are going to have lower electric rates, stronger consumer protections, more choice in electric providers, and fairer treatment for the elderly, the disabled, and other vulnerable Texans.”

AARP is supporting Hinojosa’s Senate Bill 444, a bill designed to bring stability to the state’s deregulated electricity market. Rates have risen by as much as 100 percent in the past five years, Hinojosa said, giving Texas one of the highest rates in the nation.

Hinojosa said he filed the legislation not to re-regulate the market but simply to fulfill the promises that were made when it was deregulated. His bill would lower electricity rates and strengthen consumer protections by:

•Creating a standard offer service that will be offered temporarily in the home services markets of former monopolies. This is a cost-based rate that includes a reasonable profit margin along with a mechanism to raise or lower the price as the costs of providing the service fluctuates;

•Giving customers the right to freely switch electric providers without being penalized by excessive or hidden fees. That means waiving security deposits for Texans with good payment histories and a standard service agreement so consumers can comparison shop for rates;

•Prohibiting electric companies from disconnecting electric service to vulnerable Texans (the elderly, the disabled, the poor) when temperatures hit record high or lows, as they have over the past year. Customers will still have to pay their bills but will be able to enroll in a five-month deferred payment plan;

•Restoring the state’s existing fund for seniors and low-income families. After all, Texans in deregulated markets still pay an average of 65 cents per month into this fund, known as the System Benefit Fund. But the money — currently over $400 million — is routinely used by for other programs; and

•Injecting true competition into the deregulated market by requiring electric companies to reserve at least 25 percent of their electric load for residential customers. No more cherry picking the Texas market by going after high-dollar commercial or industrial customers only.

“All Texans want is a fair price and to not have to wade through a confusing mess of rules and policies when they want to change their energy provider,” Hinojosa said.

••••••

Bill by Rep. Gonzáles, Sen. Lucio to protect names and addresses of victims of family violence, stalking, and sexual assault gets House committee hearing

By DAVID A. DIAZ

A bill that would allow the Texas Attorney General’s Office to establish an address confidentiality program to help protect victims of family violence, sexual assault, or kidnapping has passed its first hurdle by getting a public hearing before the House Juvenile Justice and Family Issues Committee.

The plan, which has 22 House co-authors, including Rep. Eddie Lucio, III, D-San Benito, and Rep. Juan Escobar, D-Kingsville/Willacy County, is being carried by Rep. Verónica Gonzáles, D-McAllen, and Sen. Eddie Lucio, Jr., D-Brownsville.

Almost 2,000 Texans would qualify for the protection in the first year, according to initial estimates presented to the Legislature, and would involve almost 114,000 piece of mail in its inaugural year.

Under the measure, the Attorney General’s Office would establish an address confidentiality program that would designate a substitute post office box address that a participant may use in place of the participant’s true residential, business, or school address; act as agent to receive service of process and mail on behalf of the participant; and forward to the participant mail received by the office of the attorney general on behalf of the participant.

Gonzáles’ version, House Bill 569, received a public hearing at the State Capitol on Wednesday, February 28. It was left pending, which is routine to allow proponents and opponents of the legislation time to hammer out compromises or add new language.

Lucio’s bill, Senate Bill 74, is awaiting a hearing before the Senate State Affairs Committee.

A similar bill, House Bill 597 by Rep. Ryan Guillen, D-Rio Grande City, also was heard on February 28 by the House Juvenile Justice and Family Issues Committee. It was also left pending.

The three measures are being opposed by the Texas Daily Newspaper Association.

According to the bill analysis prepared by the Legislative Budget Board, Gonzáles’ HB 569 would have the following impact:

Fiscal Analysis

The bill would require the Office of the Attorney General (OAG) to create and maintain an address confidentiality program to assist a victim of family violence, stalking, and sexual assault. In addition, the OAG would designate a substitute address for participants, act as the agent to receive and process mail received by the agency to participants. The OAG would also develop program and application information for participants. The bill also provides that the method of financing to implement these provisions may be from the compensation to victims of crime auxiliary fund.

Methodology

For purposes of analysis, it is assumed that approximately 1,989 participants would be included in the program in the first year and an approximate 5 percent growth rate would result in the program each following year. This information is based on comparison of other states that have similar programs.

As a result of the estimated number of participants and the requirement that the OAG receive, process, and forward first class mail and any mail sent by the government for participants in the program, it is assumed that approximately 113,134 pieces of would be received and forwarded to program participants. As a result, it is anticipated that an additional 2 FTEs would be required to handle the volume of mail and subsequent processing. The salary cost for these additional FTEs would be approximately $76,410. In addition, related costs totaling $16,156 would be required for items such as furniture, computers, and telephones. Other consumables each year thereafter would be approximately $3,500. Also for purposes of this analysis, it is estimated that 1 additional FTE would required each year thereafter as a result of a projected 5% growth rate in the number of participants in the program.

In addition to staff costs, it is assumed that approximately $83,000 would be required for envelopes, labels, and postage costs associated with forwarding mail to participants. For purposes of this analysis, a 5 percent growth rate per year in the volume of mail forwarded is assumed which would increase postage, labels, and envelopes by that percentage each year thereafter.

The OAG would also provide assistance to participants in the form of program information material and assistance with completing program applications. As a result, an additional 2 FTEs would be required at a salary cost of $91,720. In addition, related costs totaling $16,156 would be required for items such as furniture, computers, and telephones. Other consumables each year thereafter would be approximately $3,500. Furthermore, a cost of $23,000 would be required for printing brochures and application forms.

There would be no significant fiscal impact on technology.

Local Government Impact

Costs to local governmental entities to implement the provisions of the bill would depend upon the number of people who register for the address confidentiality program.

••••••

ECISD school board closes application process for superintendency position

BY GILBERT TAGLE

The Edinburg Consolidated ISD Board of Trustees has closed off the application process to fill the vacant superintendent of schools position, Dr. Jacques Treviño, school attorney, said Monday, February 26.

Treviño said the district had received 18 applications from persons interested in the job.

“Until further notice, Superintendent Gilberto Garza, Jr. will serve the Edinburg school district as interim superintendent,” said Treviño.

Garza was appointed as acting superintendent of schools last August before the start of the 2006-2007 school year. He was named interim superintendent in December.

Garza is a veteran educator (30 years) in the Edinburg school district who served as a teacher, an elementary school principal, and director of Elementary Education prior to being named by the school board as the interim superintendent of schools this.

As an administrator and interim superintendent, Garza has the responsibility of guiding and influencing the direction of an education program that will serve the needs of all students.

The Edinburg CISD is one the largest school districts in the Rio Grande Valley. It spans over 945-square miles and has s student membership nearing 30,000 in 35 schools.

••••••

Holiday retail sales in Edinburg up almost 8.3 percent over 2005

By DAVID A. DIAZ

Edinburg’s retail economy in December, as measured by the amount of local and state sales taxes generated by a wide range of local businesses, was up 8.24 percent over the same month in 2005, the Edinburg Economic Development Corporation has announced.

The EEDC is the jobs-creation arm of the Edinburg City Council.

It’s five-member governing board, which is appointed by the Edinburg City Council, includes Mayor Joe Ochoa, former Mayor Richard García, who serves as board president, Fred Palacios, Mike Govind, and George Bennack.

The figure translates into almost $1.3 million generated in local sales taxes in December. Those funds were sent in early February from the Texas Comptroller of Public Accounts, which collects the taxes from businesses, to the local communities in which the retail sales were made.

Retail businesses are required to collect both the local and state sales taxes and send them to the Texas Comptroller of Public Accounts, which soon after returns the local sales tax back to communities in the form of a rebate.

The local sales tax is used to help pay for dozens of major city services, ranging from new streets to city personnel.

January state sales tax collections and February’s local sales tax allocations primarily represent sales made in December, but also include earlier sales by businesses that report sales tax to the Comptroller on a quarterly or annual basis.

In December, Edinburg’s economy generated $1,290,247.84 in local sales taxes, compared with $1,192,007.34 in local sales taxes in December 2005.

Edinburg registered the second-best showing in Hidalgo County in December, with McAllen outpacing all major cities in the Valley.

McAllen’s economy generated more than $7.2 million in local sales taxes in December 2006, compared with more than $6.9 million during the same month last year.

According to the comptroller’s office, Hidalgo County also showed continued prosperity. In December, all cities in Hidalgo County generated more than $13.6 million in local sales taxes, up 12.22 percent over January 2005, which reached more than $12.1 million.

Neighboring Cameron County also registered economic growth, according to the state figures.

In December, all cities in Cameron County generated almost $6.5 million in local sales taxes, compared with $6.1 million during the same month in 2005.

Other major cities in Hidalgo and Cameron counties reported the following sales tax figures:

•Brownsville’s retail economy generated almost $3.6 million in local sales taxes in December 2006 compared with $3.4 million in December 2005, an increase of 5.25 percent;

•Harlingen’s retail economy generated more than $2 million in local sales taxes in December 2006, compared with more than $1.9 million in December 2005, an increase of almost five percent;

•Mission’s retail economy generated more than $1.1 million in local sales taxes in December 2006, compared with almost $993,000 in December 2005, an increase of more than 17 percent;

•Pharr’s retail economy generated more than $1 million in local sales tax activities in December 2006, compared with more than $981,000 during the same month in 2005, an increase of almost 2.7 percent; and

•Weslaco’s retail economy generated almost $870,000 in local sales tax activities in December 2006, compared with more than $757,000 in December 2005, an increase of more than 14.8 percent.

••••••

Rep. Gonzáles key author of legislation to reduce unplanned pregnancies, sexually-transmitted diseases

By RICARDO LÓPEZ-GUERRA

Rep. Verónica Gonzáles, D-McAllen, is a joint author of the Texas Prevention First Act (House Bill 1842), which aims to reduce unplanned pregnancies and curb the spread of sexually transmitted diseases (STDs).

Gonzáles said HB 1842 would expand access to preventative health care services and education programs and save public health funds for Texans across the state.

“I am proud to support the Texas Prevention First Act which will take essential steps to reducing unplanned pregnancies among our youth. Texas leads the nation in teenagers having babies, and one of every two deliveries in Texas is paid for with public dollars,” she said.

The cost of helping women prevent unplanned pregnancies is a fraction of the cost of providing government services to indigent women and their babies, she noted. A year of family planning services costs $170 for one woman, compared to $8,500 for the first year of a Medicaid-funded pregnancy.

Because of the cost effectiveness of family planning services, the federal government will provide $9 for every $1 Texas spends on our Women’s Health Program. At current levels, that program is projected to save the state $278 million over five years.

However, at current spending levels, when the Women’s Health Program is fully implemented in 2009, the program is projected to serve only 12% of the eligible population.

“Today’s investment in promoting the Women’s Health Program will benefit the State through significant savings to the State and federal government and dramatically reduce the abortion rate throughout Texas for years to come,” said Gonzáles.

“Supporting effective education and promoting statewide outreach for family planning services are essential to the successful goal to reduce unplanned pregnancies and ultimately reducing the need for abortions. The Prevention First Act is common sense, middle ground, and cost-effective policy,” Gonzáles added.

Gonzáles, Rep. Mark Strama, D-Austin, Rep. Rafael Anchia, D-Dallas;and Speaker of the House Pro Tempore Sylvester Turner, D-Houston, are joint authors for this legislation.

“Everyone should agree that reducing unplanned pregnancies is key to reducing the number of abortions. The more women that participate in this program, the fewer unintended pregnancies and abortions will occur,” said Strama.

Sen. Kirk Watson, D-Austin, and Sen. Jeff Wentworth, R-San Antonio, are authors of the companion (identical) bill in the Senate.

••••••

Sen. Lucio votes for resolution calling on audit of Texas Youth Commission

Sen. Eddie Lucio, Jr. on Wednesday, February 28, joined his colleagues in the Texas Senate as it suspended rules to meet after they adjourned earlier in the day. Senate Resolution 384 passed with a majority vote.

Lucio thanked Sen. John Whitmire, D-Houston, author of SR 384, and other senators for their leadership on this matter. He then offered the following comments:

“Members, this brings to mind a famous quote. I can’t remember whether it was Sir Winston Churchill or Pearl S. Buck, but to paraphrase the quote, it said something along the lines that ‘the true measure of a civilized society is how it treats its elderly and its prisoners.’

The idea that a situation like this could exist in our society, in Texas, in the 21st Century, speaks very poorly to our condition.

How this kind of institutionalized abuse against young people could go on for so long is a tragedy that must be rectified and those responsible held accountable. Members, we need answers and we need answers right away! I am nothing short of shocked and horrified.”

••••••

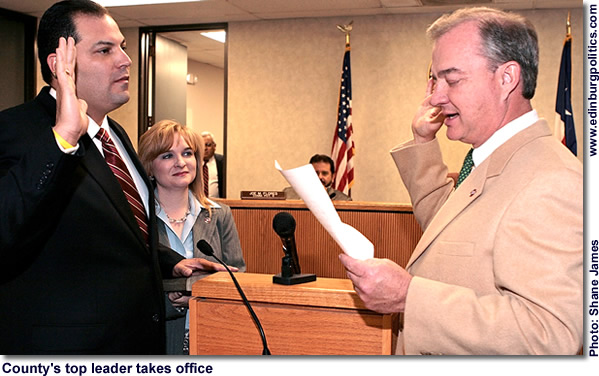

Julie González of Edinburg lands committee internship in Sen. Lucio’s Capitol office

By DORIS SÁNCHEZ

The 22-year-old recent anthropology graduate from the University of Texas Pan-American is excited to be assigned to the International Relations and Trade Committee at the Capitol that Sen. Eddie Lucio, Jr., D-Brownsville, chairs. Julie González, an Edinburg resident, underwent a rigorous selective process while trying to complete her studies to be considered for the Sen. Gregory Luna Legislative Scholar and Fellows Program.

The program, named after the late Sen. Gregory Luna of San Antonio, provides undergraduate and graduate students the opportunity to gain experience and develop leadership skills as full-time legislative assistants in the Texas Senate during legislative sessions.

“I feel very fortunate not just to have another Luna Scholar working in my office this legislative session, but I am especially thrilled that Julie is a bona fide constituent from my district,” said Lucio. “She is an asset to the work we are doing for the people of Texas.”

Ms. González is fulfilling a five-month internship in the senator’s IRT Committee that he chairs. Her duties include researching policy matters, constituent issues and helping develop legislation.

“I am very glad Sen. Lucio opens the doors of his office to Luna Scholars,” noted Ms. González. “I am learning a great deal about Texas government from him, and especially as a staff member of his IRT Committee.”

The former migrant student has overcome tremendous challenges to complete college. She credits her mother, Martina Salazar of Edinburg, with motivating her to excel and continue her education. Ms. González said that her stepfather, Frank Salazar of Edinburg, who died suddenly in March 2005, while she was a junior in college, left a deep void in her life but her mother’s strength “got her and her four siblings through it.”

Some of her goals are to complete graduate school—she is currently applying to several schools—and one day work at the United Nations. She enjoys helping colonia residents get involved in the political process, and she has volunteered her time to organize carpools in the colonias for the voting polls. Ms. González has deep religious convictions and considers her family, her church and her education primary in her life.

••••••

ECISD board awards $5.6 million contract to Descon Construction to add wings to six elementary schools

By GILBERT TAGLE

Construction on classroom wings at six elementary schools will soon begin following approval of Descon Construction LP of McAllen to serve as the project contractor.

The Edinburg school board approved RFP#17-110 to build classroom wings at Canterbury, Escandón, Zavala, Guerra, Kennedy and Truman elementary schools at a cost of $5.6 million to address the growth in the elementary schools.

In August, the school board adopted a district budget for the 2006-2007 school year which includes the funds necessary to build classroom wings to existing elementary schools to address rising student numbers at the elementary level.

The district’s student enrollment is at 29,000 students. The bulk of the new growth continues to be seen at the elementary level where the increased numbers equate to more than one new elementary school. Elementary figures for all 27 schools reached 15,401or 703 more students than last school year.

The majority of the new elementary growth is in grades one through four. The district has 2,514 first graders (an increase of 154); 2,375 second graders (an increase of 149); 2,297 third graders (an increase of 124); and 2,212 fourth graders (an increase of 115). Pre-kindergarten numbers are up by 69 students for a total of 1,348 students who attend a half-day of pre-school classes.

The district has five elementary schools whose numbers have surpassed the 700 mark and four that are near to reaching it. The five schools feeling the added strain are Ávila Elementary with 771 students, Eisenhower with 778 students, Escandón with 724 students, Villarreal with 734 students and Treviño with 716 students.

Nearing the 700 mark are Betts Elementary with 677 students, Freddy González with 660, Guerra with 655 students and Truman with 648 students.

••••••

Lincoln, Cavazos, Hargill schools named Title I Distinguished Performance School

By GILBERT TAGLE

Lincoln, Cavazos, and Hargill Elementary Schools have been recognized by the Division of the No Child Left Behind Program Coordination at the Texas Education Agency (TEA) as Distinguished Title I, Part A Schools.

The three Edinburg CISD schools are among 129 Texas schools recognized for their outstanding academic performance. According to the TEA, the campuses are being recognized for consistently strong academic performance while educating large populations of impoverished students during the three previous school years.

Under criteria set by the TEA’s No Child Left Behind division, a Title I campus

qualified for the honor if the campus:

•Met Adequate Yearly Progress standards under the federal accountability evaluation system both this year and in 2005;

•Earned the state’s highest accountability rating of exemplary in 2006; and

•Earned an exemplary or recognized rating, which is the second highest rating in the state accountability system, during the two previous school years.

The Edinburg CISD was one of five Valley school districts with schools recognized as Distinguished Title I, Part A Schools.

Title I, Part A is a federal program under the Elementary and Secondary Education Act (ESEA). It provides supplemental funding to school districts with high concentrations of students from low-income families. Funds support programs that enable all children to meet the state’s student performance standards. These programs must use instructional methods and strategies that are grounded in scientifically based research.

The performance standards increase each year in the state’s accountability system. Under the rating system in 2006, for example, schools that earned an Exemplary rating had passing rates of 90 percent or more on the Texas Assessment of Knowledge and Skills (TAKS) for all students and each student group; a passing rate of 90 percent or more on the State-Developed Alternative Assessment II (SDAA II) for all students; a high school completion rate of 95.0 percent and an annual dropout rate for students in grades 7-8 of 0.2 percent or less for all students and each student group.

To earn a recognized rating, the campus must have at least 70 percent of students pass TAKS and SDAA II for all students and each student group; have a high school completion rate of 85.0 percent; and an annual dropout rate of 0.7 percent or less.

AYP evaluations are based on participation and performance on state reading/English language arts (ELA) and mathematics exams in grades 3-8 and 10; graduation rates and attendance rates.

The data are analyzed for all students and each of the following student groups that meet minimum size requirements: African American, Hispanic, white, economically disadvantaged, special education and limited English proficient.

Edinburg CISD Interim Superintendent of Schools, Gilberto Garza Jr., said the Texas Education Agency bestows the prestigious Title I Distinguished School designation on identified Texas campuses due to their consistently strong academic performances while educating large populations of impoverished students during the three previous school years.

Garza said to qualify for this designation in Texas, a school must be a Title I campus, have earned the state’s highest accountability rating (called exemplary) in the last school year and earned either an exemplary or recognized rating, which is the second highest rating awarded by the state, during the two previous school years.

“Congratulations to these outstanding 129 distinguished performance schools and the 13 distinguished progress schools,” said TEA Commissioner of Education Shirley J. Neeley. “Their hard work has resulted in strong academic success.”

The honored schools are among 5,486 Title I schools that will receive $1.1 billion in federal funding through the Title I program in 2006-07. Federal law requires each state to identify those Title I schools that are meeting or exceeding the state’s definition of adequate yearly progress. The campuses will be recognized later this spring by their respective Education Service Centers.

••••••

EHS senior Luis Emilio Quintanilla at attend Presidential Classroom Scholars Program in D.C.

Edinburg High School senior Luis Emilio Quintanilla will attend the Presidential Classroom Scholars Program, in Washington D.C.

Presidential Classroom expands students’ knowledge of politics, government, and roles and responsibilities of institutions and organizations involved in policy-making. Through interactive sessions with international policy-makers, diplomats, scientists, military leaders, journalists, public officials and others, Luis will gain insights into the complexities of the policy-making process, as well as the interaction between government entities and organizations around the world.

Luis will work with peers from all over the nation on a group project throughout the week, applying new skills and ideas immediately after learning them.

“Presidential Classroom is dedicated to challenging the leaders of tomorrow to learn, understand and take action on the formidable problems that face our nation and our world,” said Presidential Classroom Executive Director Elizabeth A. Sherman, Ph.D. “With Washington, DC as our classroom, we attract outstanding high school students to a series of discussions with influential leaders and policy makers, site visits to national institutions, exercises and debates on topics of prominent importance, and interaction with teachers, mentors, and peers. I am delighted to welcome this student to join Presidential Classroom for what promises to be a vital step toward civic engagement and meaningful participation in public leadership.”

••••••

Congressman Cuellar announces $247,500 grant for Food Bank of the Rio Grande Valley

Congressman Henry Cuellar, D-Laredo/McAllen, on Friday, March 2, announced that the Food Bank of the Rio Grande Valley has been awarded $247,500 from Housing and Urban Development.

The Food Bank of the Rio Grande Valley is the fourth largest in Texas, and includes Starr, Hidalgo, Cameron, and Willacy counties. The grant is approved as an Economic Development Initiative (EDI) Special Project, a program under HUD.

“This grant will help further the Food Bank project, which assists many communities across the Rio Grande Valley,” said Cuellar.

While this grant may be used in a variety of ways, the grant will be used for the purchase and renovation of a 111,000 sq. ft. historic building in Pharr, Texas. EDI provides grants for two reasons:

•To enhance the security of loans guaranteed through the section 108 program, and

•To enhance the feasibility of the economic development and revitalization projects that they finance.

Terry Drefke, Rio grande Valley Food Bank Director, echoed these statements by saying, “We are very pleased to receive the EDI Special Project Grant for $247,500; it will be used for the renovation and purchase the Valley fruit and vegetable facility in Pharr. This money will have a significant impact on our project.”

Cuellar continued, “I would like to commend my colleague, Congressman Ruben Hinojosa, for his continued efforts to improve many communities in South Texas. I will continue fighting to ensure that every citizen is provided with the proper means to not go hungry and stay healthy.”

Congressman Henry Cuellar is a member of the House Homeland Security, Small Business, and Agriculture Committees in the 110th Congress; accessibility to constituents, education, health care, economic development, and national security are his priorities. Congressman Cuellar is also a Majority Senior Whip

••••••

Senate committee grills HHS commissioner Hawkins HBP vaccinations

Health and Human Service Commissioner Albert Hawkins appeared before the Senate Nominations Committee on Wednesday, February 28, to seek re-approval for his appointment, but Senators were less interested in his past performance than how he would administer a controversial vaccination program.

Earlier this year, Gov. Rick Perry issued an executive order directing the Commissioner of the HHSC to create guidelines requiring a vaccination for the human papillomavirus (HPV) for young girls entering the sixth grade. This has proved to be a controversial order, which has raised questions about the balance of power in state government, parents’ rights, and possible connections between the Office of the Governor and the company that makes the HPV vaccine.

Hawkins began by laying out the agency’s accomplishments since he took over in 2003. He says under his watch, HHSC has eliminated administrative waste and redundancies, implemented a preferred drug program that has saved the state $488 million since 2004, and improved Medicaid service.

The HPV vaccination executive order was the central theme of the questions asked by members to Hawkins. “Executive orders are for emergencies,” said Sen. Kevin Eltife, R-Tyler, “In your opinion as Commissioner of Health, is this [HPV] an emergency?” Hawkins said he could not answer the question, because he is “unable to make a predetermination about the outcome of the rules making process.”

Eltife, who after repeatedly rephrasing the question, was unable to get Hawkins to commit to a yes or no answer, and said that he could not support Hawkins’ nomination if he could not give a direct response.

Sen. Jane Nelson, R-Lewisville, who chairs the Senate Health and Human Services Committee, tried to get Hawkins to answer the emergency question another way, asking him to rank the top ten health issues facing Texas. Along with Medicaid, treatment of the elderly and disabled, and uninsured Texans, Hawkins said he felt that cancer treatment and prevention, including cervical cancer, was a top ten issue.

Nelson was also unhappy that a HPV study report mandated by one of her bills last session had not been delivered to Legislators by the stipulated date. “If I was the boss, and I found out who was in charge of getting that report to the Legislature, heads would roll,” she said.

Hawkins promised to discover why the report had yet to be delivered.

Following about two hours of questions, Nominations Committee Chairman Mike Jackson, R-La Porte, left Hawkins’ nomination as pending business before the committee to be voted on at a later date.

Also on February 28, Senate Education Committee Chair Florence Shapiro, R-Plano, announced legislation that would give parents with children with autism the right to transfer their children into schools that have better autism education programs.

Autism is a neurological disorder that impairs societal skills along a broad spectrum. It is the broad range of symptoms, said Shapiro, that makes it so hard to offer special education services to autistic children.

“Because symptoms can vary so greatly, a program that works for one child may not be effective for another,” said Shapiro. “That is why individualized programs are so important.” Senate Bill 1000 gfhywould permit parents of autistic children to move their children into another school, including an accredited private school. Schools that take these students would be reimbursed by the state at the same amount the student would receive in state funds at their old schools.

The Senate will reconvene Monday, March 5 at 3 p.m.

Session video and all other webcast recordings can be accessed from the Senate website’s audio and video archive pages.

••••••

Sen. Zaffirini files bill to protect Texans from “Botnets,” cybercrimes

By NICK ALMANZA

Sen. Judith Zaffirini, D-Laredo, filed legislation on Wednesday, February 28, to combat the use of “botnets”—networks of compromised computers used to perpetrate cybercrime. Senate Bill 1009 by Zaffirini will prohibit the creation of botnets and penalize convicted violators with significant fines.

“The rapid growth of e-commerce has led to the proliferation of online advertisements and devices that allow criminals to install dangerous software that victimizes Texas consumers,” Zaffirini said. “As legislators we have the responsibility to protect consumers and internet users from cybercrimes. This bill will not only protect online users in Texas from botnets, but also will enhance the security of personal and private information stored on computers.”

SB 1009 will define clearly the term “bot” as a software program that operates as an agent for a user, another computer program or simulates human activity, and “botnet” as a collection of computers that become compromised without the knowledge of the owner or operators. Compromised computers either run under a command and control infrastructure or are used to forward transmissions, including unsolicited e-mails and viruses, to other computers with online access. What’s more, the bill will authorize civil penalties for using botnets, including a cause of action for victims, and authorize the attorney general to seek injunctive relief and recovery of damages of $100,000 per violation.

Similar to SB 6 filed last week, SB 1009 builds on Zaffirini’s legislation that protects families from online crimes. In 2005 she authored and passed SB 327, the Consumer Protection Against Spyware Act, which made it unlawful for a person or entity to knowingly install spyware. The protections created by SB 327 produced a multimillion dollar settlement with Sony BMG Music, which installed harmful and problematic “spyware” on more than 100 compact discs sold to Texas consumers.

In 2005, Zaffirini also sponsored and passed HB 1098 by Rep. Brian McCall, R-Plano, which prohibited internet “phishing” or fraudulent websites and e-mails sent to induce victims to divulge personal financial information.

“Botnets allow cybercriminals to perpetrate a number of unauthorized actions, including sending unsolicited e-mails, attacking vulnerable computer systems and networks, committing click fraud, and hijacking personal information leading to identity theft,” Senator Zaffirini said. “Cybercriminals must be punished swiftly and decisively for their crimes, and consumers must remain confident that online transactions will be kept secure. I look forward to passing this bill and will continue to champion consumer rights and protections for all Texans.”

••••••

South Texas College to offer Mexican-American Studies Program starting fall 2007

By HELEN ESCOBAR

Starting in the fall 2007 semester, South Texas College will be offering a new Mexican-American Studies Program (MASP) providing students the opportunity to learn about more than 4,000 years of Mexican-American history, culture and heritage. Students following the program will earn a full Associate of Arts in Mexican-American Studies, which will provide a solid foundation for bachelor’s programs in Mexican-American Studies, education, English, government, political science, economics, history, art, business or a variety of other subjects.

“This is a real milestone for STC because we are located in the heart of the Rio Grande Valley and this topic is of utmost importance for our students and the community,” said Dr. Margaretha Bischoff, interim division dean of Liberal Arts and Social Sciences for STC. “Many of our students are interested in learning more about how they fit into the grand picture of Mexican-America today and this program will lay the foundation for them, outlining the accomplishments and the long history of Mexican-Americans. It will interweave history with developments in art, music, literature, language, economics and many other facets of culture to provide a clearer picture of what is has meant and means to be Mexican-American.”

STC is only one of six college’s offering a degree program in Mexican-American Studies in the entire state of Texas. Others include The University of Texas-Pan American, The University of Texas-Austin, The University if Texas-San Antonio, The University of Texas-El Paso and Sul Ross State University.

“I am thrilled that we are able to move forward with this important program for the college and our students and it is even more impressive that we are one of a handful of colleges, much less community colleges, in the state that are aggressively pursuing this opportunity,” said Gilberto Reyes, Jr., History instructor for STC. “I think many students will be surprised to learn about the history and culture associated with Mexican-Americans and will gain a better understanding of what the term ‘Mexican-American’ truly means. We are living in a post-NAFTA world in which Hispanics are gaining more and more influence in every level of society and it is important to explore our history and ideas to influence the future in positive ways.”

In addition to 15 credit hours in the MASP field of study, students interested in the program must take “Introduction to Mexican American Studies” and earn 45 credits in the college’s core curriculum. It is anticipated that the program will also overview local Valley culture and history, focusing on important influences originating from the Valley like Tejano and Conjunto music, Tex-Mex food and language deviations, political forces, as well as other topics.

“I think it will be great to for us to have the opportunity to learn about our culture, history, customs and our Mexican-American leaders,” said 23-year-old Education major Zandra Garcia. “I would really like to take some of the courses next semester.”

“I think this is great because it’s crucial that we learn about our culture and history, especially for members of the younger generation like me,” said 19-year-old Nursing major Omar Chavez. “We don’t know where we are going unless we know where we are from.”

To supplement the degree program, Mexican-American Studies Clubs will also be available for student participation at each of STC’s three campuses. The clubs will support academic instruction, providing opportunities for participation in a variety of cultural events, hands-on leadership projects and service projects.

For more information about this new program, area residents may contact Gilberto Reyes, Jr. at 872-2170 or [email protected].

••••••

Joaquín A. Rodríguez of Edinburg, 2007 Texas Youth of the Year finalist, honored by Texas Senate

Joaquín A. Rodríguez, a senior at Edinburg High School and a 2007 Texas Youth of the Year finalist for the Boys and Girls Club of America, on Tuesday, February 27, was honored for his many achievements by the Texas Senate.

The congratulatory measure, Senate Resolution No. 366 filed by Sen. Juan “Chuy” Hinojosa, D-McAllen, follows:

SENATE RESOLUTION NO. 366

WHEREAS, The Senate of the State of Texas is pleased to recognize Joaquín A. Rodríguez, a senior at Edinburg High School, who was recently named a 2007 Texas Youth of the Year finalist by the Boys and Girls Clubs of America; and

WHEREAS, Boys and Girls Clubs are neighborhood-based programs that address today’s most pressing issues for young people; the clubs promote improved self-image for members and

encourage community involvement, strong moral values, and improved life management skills; and

WHEREAS, Joaquín has been a member of the Boys and Girls Clubs of Edinburg for two years; he is regional president of the Business Professionals of America; he implemented a community service program, Operation Save the Fish, in which senior members of the Advanced Via Individual Determination program tutor freshmen members; and

WHEREAS, Joaquín serves on the Boys and Girls Clubs’ Teen Court and the National Steering Committee for the Keystone Club, the clubs’ leadership development program; he plans to study computer science and law at Stanford University; and

WHEREAS, Joaquín’s selection as a Texas Youth of the Year finalist is a tribute to his exceptional talents and his enthusiasm for service; he is an exemplary young man, and he demonstrates the fine spirit shown by the many young people in the State of Texas who volunteer to improve their communities; now, therefore, be it

RESOLVED, That the Senate of the State of Texas, 80th Legislature, hereby commend Joaquín A. Rodríguez for being a 2007 Texas Youth of the Year finalist and extend to him best wishes for success in the future; and, be it further

RESOLVED, That a copy of this Resolution be prepared for him as an expression of esteem from the Texas Senate.

••••••

Edinburg City Council to hear presentation on La Sienna Development during Tuesday, March 6 public session

EDINBURG CITY COUNCIL

CITY OF EDINBURG,

HIDALGO COUNTY, TEXAS

Location: University of Texas – Pan American

International Trade and Technology Building

1201 West University Drive

300 Block, Dr. Miguel Nevarez Drive

MARCH 06, 2007

WORK SESSION AGENDA 6:00 P.M.

I. Presentation on La Sienna Development by Bill Calderon with Hawes Hill Calderon LLP.

II. Discussion and Update on the Construction of Lift Station No. 25.

REGULAR MEETING AGENDA 7:00 P.M.

I. CALL TO ORDER, ESTABLISH QUORUM.

A. Prayer.

B. Pledge of Allegiance, Alma A. Garza, Councilmember

II. CERTIFICATION OF PUBLIC NOTICE.

III. PUBLIC COMMENTS.

IV. MAYOR’S REPORT.

V. CITY MANAGER’S REPORT.

VI. PRESENTATIONS.

A. Presentation of Proclamation Recognizing March 2007 as National Colorectal Cancer Awareness Month.

B. Presentation of Proclamation Recognizing March 4th-10th as Severe Weather Awareness Week.

C. Consider Presentation of Delinquent Tax Collection Report for the period of October 01, 2006 to February 28, 2007.

VII. PUBLIC HEARINGS/ORDINANCES.

A. Hold Public Hearing and Consider Ordinances Providing for a Comprehensive Plan Amendment From Auto-Urban Uses to General Commercial Uses and the Rezoning Request From R-A1, Single Family Residence District to C-2, General Business District, being 1.23 acres out of Lot 12, Block 2, Santa Cruz Gardens Unit No.3 Subdivision, located approximately 170.70 feet east of Gwin Road on the north side of Monte Cristo Road, as requested by Estefana Galvan.

B. Hold Public Hearing and Consider Ordinance Providing for the Rezoning Request from R-A1, Single Family Residence District to C-1, Local Business District, being 0.506 acre tract of land, more or less, out of lot 2, Section 275, Texas-Mexican Railway Company Survey, located approximately 433.50 feet south of Sprague Street on the east side of McColl Road, as requested by Amando Guerra.

C. Hold Public Hearing and Consider Ordinance Providing the Renewal of a Special Use Permit for an On-Premise Consumption of Alcoholic Beverages for Mango’s Sports Bar, being 1.87 acres out of Lot 5, Block B, Edinburg Adjacent Acreage, located at 909 North Closner Boulevard requested by Jose Francisco Quevedo.

D. Consider an Ordinance of the City of Edinburg, Texas Finding, after Reasonable Notice and Hearing, that AEP Texas Central Company’s Existing Rates are Unreasonable; Finding that AEP Texas Central Company’s Requested Revenues Resulting from Electric Transmission and Distribution Rates and Charges within the City Should be Reduced; Determining Just and Reasonable Rates; Adopting Recommendations of Consultants; Providing for Recovery of Rate Case Expenses; Preserving Regulatory Rights of the City; Providing a Waiver of the Three (3) Separate Readings; and Ordaining Other Provisions Related to the Subject Matter Hereof.

VIII. APPOINTMENTS.

Consider Appointments to the City Advisory Boards and Committees for the Following: Environment Board, Two Members, Community Development Council-Area 10, One Member, Parks and Recreation Board, One Member, Civil Service Commission, One Member.

IX. AWARDING OF BIDS/CONTRACTUALS.

A. Consider Awarding Bid No. 2007-44, Demolition and Reconstruction of a Two-Story Burn Complex to 5 Star Construction.

B. Consider Awarding Bid Number 2007-52, Reconstruction of One (1) Residence in the Housing Assistance Program to Benchmark Construction.

C. Consider Awarding Bid Number 2007-54, Reconstruction of One (1) Residence in the Housing Assistance Program to Benchmark Construction.

D. Consider Awarding Bid Number 2007-55, Colonia Rodriguez Water & Drainage Improvements to JLV Utility Construction, LLC, in the Amount of $222,540.

E. Consider Awarding of Bid Number 2007-57, Replacement of Plant Lift Gate Valves to American Machine Shop & Pumps, in the Amount of $45,000.

F. Consider Awarding Bid Number 2007-58, Lift Station No. 22-Pumps & Valves to American Machine Shop & Pumps, in the Amount of $24,892.

G. Consider Awarding Bid Number 2007-61, 2007 Haul Truck to South Texas Freightliner, in the Amount of $84,270.

H. Consider Awarding Bid Number 2007-62, 2007 End Dump Trailer to Rush Equipment Centers of Texas, Inc., in the Amount of $61,125.

I. Consider Purchase of Aeration Diffusers for the Utility/Wastewater Treatment Plant from Hartwell Environmental Corporation, in the Amount of $42,940.

J. Consider Selecting a Qualified Firm for the Construction Materials Testing and Geotechnical Services for the Edinburg West Water Treatment Plant and Authorize the Interim City Manager to Negotiate a Professional Services Agreement.

K. Consider Authorizing Interim City Manager to Accept Improvement Proposal and Execute the Necessary Construction Agreements for Improvements at the Edinburg Baseball Stadium, as submitted by Edinburg Equities, LLC.

X. CONSENT AGENDA.

A. Consider Resolution to the Board of Directors of the South Texas Higher Education Authority, Inc.; Approving Directors and Terms.

B. Consider Resolution by the City Council of the City of Edinburg, Texas, Relating to the Issuance of Obligations by the South Texas Higher Education Authority, Inc.; Approving the Issuance of Such Obligations; and Making Certain Findings in Connection Therewith.

C. Consider Authorizing Interim City Manager to Accept Proposal and Enter Into an Engineering Agreement with Golder Associates, Inc. for the Preparation and Procurement of an Air Emission General Operating Permit as Mandated Under Title 30 Chapter 122 of Texas Administrative Code, Pending Approval of Final Form by Interim City Manager and City Attorney.

XI. EXECUTIVE SESSION.

The City Council will convene in Executive Session, in accordance with the Texas Open Meetings Act, Vernon’s Texas Statutes and Codes Annotated, Government Code, Chapter 551, Subchapter D, Exceptions to Requirement that Meetings be Open, §551.071, Consultation with Attorney and §551.074, Personnel Matters; Closed Meeting.

1. Settlement Proposal Regarding Cause No. CCD-1493-A; City of Edinburg vs. Grande Valley Homes; In the County Court at Law No. 1 of Hidalgo County, Texas.

2. Evaluation of City Attorney.

3. Discussion on Personnel Matters: Search for City Manager.

4. Discussion: On Construction of Lift Station No. 25.

OPEN SESSION

The City Council will convene in Open Session to take necessary action, if any, in accordance with Chapter 551, Open Meetings, Subchapter E, Procedures Relating to Closed Meeting, §551.102, Requirement to Vote or Take Final Action in Open Meeting.

XII. ADJOURNMENT.

I hereby certify this Notice of a City Council Meeting was posted in accordance with the Open Meetings Act, at both bulletin boards located at the main entrances to the City Offices of the City of Edinburg, and at the 210 West McIntyre entrance outside bulletin board, visible and accessible to the general public during and after regular working hours. This notice was posted on March 2, 2007 at 7:05 p.m.

By: /s/Myra L. Ayala Garza, City Secretary

City of Edinburg, Texas

[All matters listed under Consent Agenda are considered to be routine by the Governing Body and will be enacted by one motion. There will be no separate discussion of these items. If discussion is desired, that item will be removed from the consent agenda and will be considered separately.]